#50: African Currencies Retain Strong Momentum in 2025 -- against the dollar

A look at the Strongest Performers

The Top 10 African countries with the strongest currencies have maintained their spots from last year and even gained more momentum this year. Here are some notable charts. (Note that the declining slopes show it takes FEWER units of the local currencies to buy a USD):

🇹🇳 Tunisian Dinar

The Tunisian Dinar (TND) has kept its title as the best performing African currency, due to several factors such as well-managed exchange rate, robust tourism earnings and remittances from the diaspora, and low imports.

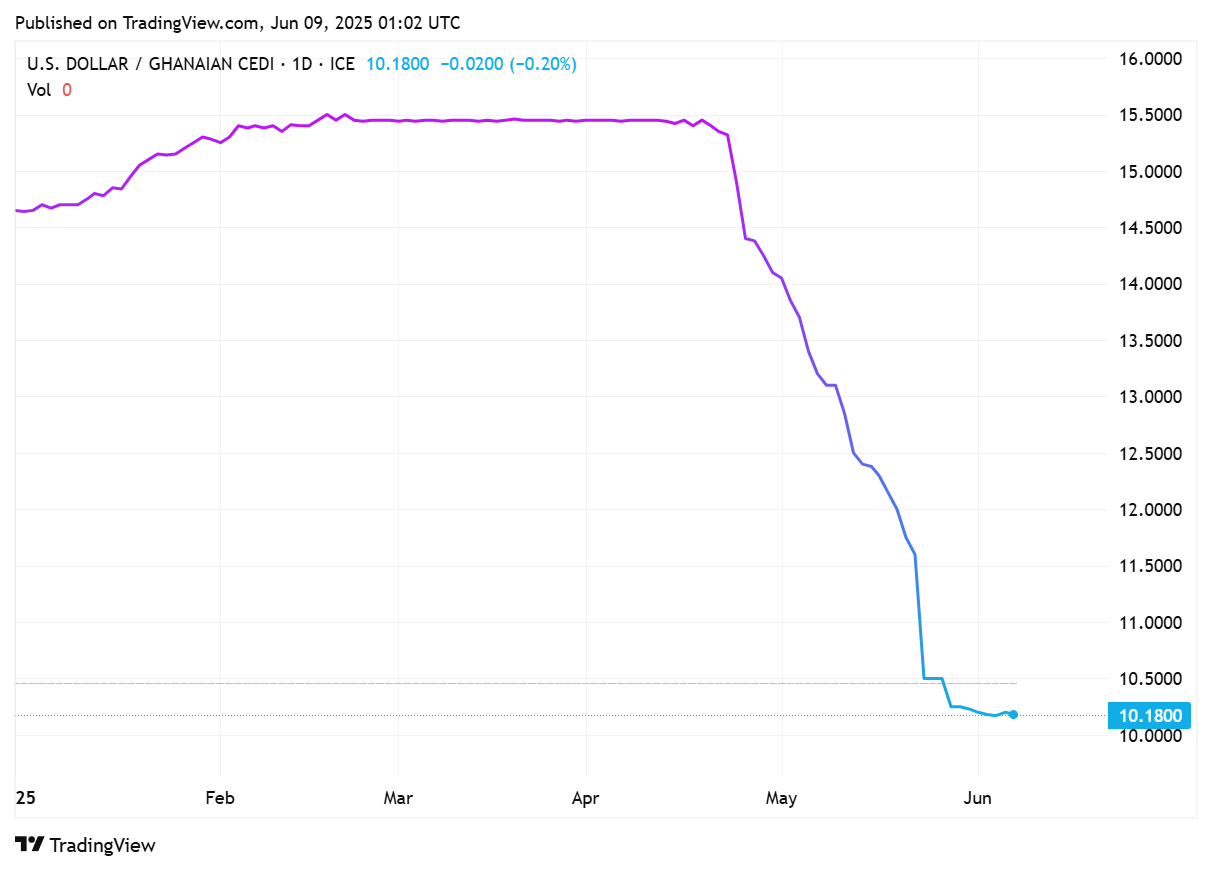

🇬🇭 Ghanaian Cedi

Last year, our African Lions Fund team visited Ghana for boots-on-the-ground research, and we have documented this on our Global Value Hunter blog: Investing In Ghana: Opportunity Or Risk?

Among other things, our CEO Tim Staermose, gave a brief overview of the Ghanaian Cedi’s recent demise:

In 2022, Ghana defaulted on both its overseas USD-denominated Eurobond debt and, in what was an especially shocking development, also refused to pay back domestic government bond obligations to several local creditor segments, including the banks.

Since then, the Ghanaian Cedi has been among the worst performing currencies in Africa and shows no sign of rebounding. In the time I have been investing in the Ghana stock exchange, the Cedi has gone from 5.77 to the USD dollar to 15.75 (or 16 on the parallel market). That’s a loss of 63% of its value.

But, it looks like a reversion to the mean was overdue. Today, the Cedi is at 10.18, halfway back to where it was when The Fund started investing.

The Resurgence of the Ghana Cedi: Analyzing the Drivers Behind Its 2025 Appreciation

🇧🇼 Botswana Pula

The Botswana Pula (BWP), Botswana’s official currency since 1976, has long been admired as one of the most stable currencies in Africa. But what makes the pula so distinctive, and why is it so important to Botswana’s economy? This post dives into the history, features, and value of the pula, its role in daily life and trade, and its significance as a symbol of Botswana’s resilience and economic strength.

Here’s the full list published by Business Insider Africa:

Meanwhile, the current general view for African currencies seem to be net positive. This article, AFRICA-FX-Most currencies expected to be stable, is part of a weekly African currency outlook which is has been consistently singing the same song this year. Even the Zambian Kwacha, which is a poster child of a volatile African currency has started showing signs of stability.

The Zambian kwacha's trajectory is central to this narrative. While the currency's appreciation against the dollar in recent months has eased import pressures, its long-term stability depends on resolving external debt overhangs and improving fiscal credibility.

Investors should monitor the kwacha's performance closely. A stable or appreciating currency would reduce import-driven inflation, allowing the central bank to cut rates sooner. Conversely, renewed depreciation could reignite price pressures, forcing further rate hikes and widening bond spreads.

Source: Zambia's Inflation Slowdown: A Strategic Opportunity in Emerging Market Debt

To close this issue and just for a bit of fun, there are notable Africans making a small fortune with forex. Here’s one story of success . . .